Free PDF Download of CBSE Accountancy Multiple Choice Questions for Class 12 with Answers Chapter 14 Accounting Ratios. Accountancy MCQs for Class 12 Chapter Wise with Answers PDF Download was Prepared Based on Latest Exam Pattern. Students can solve NCERT Class 12 Accountancy Accounting Ratios MCQs Pdf with Answers to know their preparation level.

Accounting Ratios Class 12 Accountancy MCQs Pdf

Multiple Choice Questions

Select the best alternate and check your answer with the answers given at the end of the book.

(A) Liquidity Ratios

1. Two basic measures of liquidity are :

(A) Inventory turnover and Current ratio

(B) Current ratio and Quick ratio

(C) Gross Profit ratio and Operating ratio

(D) Current ratio and Average Collection period

Answer

Answer: B

2. Current Ratio is :

(A) Solvency Ratio

(B) Liquidity Ratio

(C) Activity Ratio

(D) Profitability Ratio

Answer

Answer: B

3. Current Ratio is :

(A) Liquid Assets/Current Assets

(B) Fixed Assets/Current Assets

(C) Current Assets/Current Liabilities

(D) Liquid Assets/Current Liabilities

Answer

Answer: C

4. Liquid Assets do not include :

(A) Bills Receivable

(B) Debtors

(C) Inventory

(D) Bank Balance

Answer

Answer: C

5. Ideal Current Ratio is :

(A) 1 : 1

(B) 1 : 2

(C) 1 : 3

(D) 2 : 1

Answer

Answer: D

6. Working Capital is the :

(A) Cash and Bank Balance

(B) Capital borrowed from the Banks

(C) Difference between Current Assets and Current Liabilities

(D) Difference between Current Assets and Fixed Assets

Answer

Answer: C

7. Current assets include only those assets which are expected to be realised within ……………………..

(A) 3 months

(B) 6 months

(C) 1 year

(D) 2 years

Answer

Answer: C

8. The ………………… of a business firm is measured by its ability to satisfy its short term obligations as they become due.

(A) Activity

(B) Liquidity

(C) Debt

(D) Profitability

Answer

Answer: B

9. Ideal Quick Ratio is :

(A) 1 : 1

(B) 1 : 2

(C) 1 : 3

(D) 2 : 1

Answer

Answer: A

10. Quick Assets do not include

(A) Cash in hand

(B) Prepaid Expenses

(C) Marketable Securities

(D) Trade Receivables

Answer

Answer: B

11. Current Assets do not include :

(A) Prepaid Expenses

(B) Inventory

(C) Goodwill

(D) Bills Receivable

Answer

Answer: C

12. Quick Ratio is also known as :

(A) Liquid Ratio

(B) Current Ratio

(C) Working Capital Ratio

(D) None of the Above

Answer

Answer: A

13. Liquid Assets include :

(A) Debtors

(B) Bills Receivable

(C) Bank Balance

(D) All of the Above

Answer

Answer: D

14. Liquid Ratio is equal to liquid assets divided by :

(A) Non-Current Liabilities

(B) Current Liabilities

(C) Total Liabilities

(D) Contingent Liabilities

Answer

Answer: B

15. Patents and Copyrights fall under the category of:

(A) Current Assets

(B) Liquid Assets

(C) Intangible Assets

(D) None of Above

Answer

Answer: C

16. Cash Balance ₹15,000; Trade Receivables ₹35,000; Inventory ₹40,000; Trade Payables ₹24,000 and Bank Overdraft is ₹6,000. Current Ratio will

be :

(A) 3.75 : 1

(B) 3 : 1

(C) 1 : 3

(D) 1 : 3.75

Answer

Answer: B

17. Trade Receivables ?40,000; Trade Payables ₹60,000; Prepaid Expenses ₹10,000; Inventory ₹1,00,000 and Goodwill is ₹15,000. Current Ratio will be :

(A) 1 : 2

(B) 2 : 1

(C) 2.33 : 1

(D) 2.5 : 1

Answer

Answer: D

18. Cash Balance ₹5,000; Trade Payables ₹40,000; Inventory ₹50,000; Trade Receivables ₹65,000 and Prepaid Expenses are ₹10,000. Liquid Ratio will be

(A) 1.75 : 1

(B) 2 : 1

(C) 3.25 : 1

(D) 3 : 1

Answer

Answer: A

19. Current Assets ₹4,00,000; Current Liabilities ₹2,00,000 and Inventory is ₹50,000. Liquid Ratio will be :

(A) 2 : 1

(B) 2.25 : 1

(C) 4 : 7

(D) 1.75 : 1

Answer

Answer: D

20. Which of the following transactions will improve the Current Ratio :

(A) Cash Collected from Trade Receivables

(B) Purchase of goods for cash

(C) Payment to Trade Payables

(D) Credit purchase of Goods

Answer

Answer: C

21. Which of the following transactions will improve the quick ratio?

(A) Sale of goods for cash

(B) Sale of goods on credit

(C) Issue of new shares for cash

(D) All of the Above

Answer

Answer: D

22. A company’s Current Ratio is 2 : 1. After cash payment to some of its creditors, Current Ratio will:

(A) Decrease

(B) Increase

(C) As before

(D) None of these

Answer

Answer: B

23. A Company’s Current Assets are ₹8,00,000 and its current liabilities are ₹4,00,000. Subsequently, it purchased goods for ₹1,00,000 on credit. Current ratio will be

(A) 2 : 1

(B) 2.25 : 1

(C) 1.8 : 1

(D) 1.6 : 1

Answer

Answer: C

24, A company’s Current assets are ₹3,00,000 and its current liabilities are ₹2,00,000. Subsequently, it paid ₹50,000 to its trade payables. Current ratio will be

(A) 2 : 1

(B) 1.67 : 1

(C) 1.25 : 1

(D) 1.5 : 1

Answer

Answer: B

25. Current Assets of a Company were ? 1,00,000 and its current ratio was 2 : 1. After this the company paid ?25,000 to a Trade Payable. The Current Ratio after the payment will be :

(A) 5 : 1

(B) 2 : 1

(C) 3 : 1

(D) 4 : 1

Answer

Answer: C

26. Current liabilities of a company were ₹2,00,000 and its current ratio was 2.5 : 1. After this the company paid ₹1,00,000 to a trade payable. The current ratio after the payment will be :

(A) 2 : 1

(B) 4 : 1

(C) 5 : 1

(D) None of the above

Answer

Answer: B

27. A Company’s liquid assets are ₹10,00,000 and its current liabilities are ₹8,00,000. Subsequently, it purchased goods for ₹1,00,000 on credit. Quick ratio will be

(A) 1.11 : 1

(B) 1.22 : 1

(C) 1.38 : 1

(D) 1.25 : 1

Answer

Answer: A

28. A Company’s liquid assets are ₹5,00,000 and its current liabilities are ₹3,00,000. Thereafter, it paid 1,00,000 to its trade payables. Quick ratio will be:

(A) 1.33 : 1

(B) 2.5 : 1

(C) 1.67 : 1

(D) 2 : 1

Answer

Answer: D

29. The is a measure of liquidity which excludes generally the least liquid asset.

(A) Current ratio, Accounts receivable

(B) Liquid ratio, Accounts receivable

(C) Current ratio, inventory

(D) Liquid ratio, inventory

Answer

Answer: D

30. Assuming that the current ratio is 2 : 1, purchase of goods on credit would:

(A) Increase Current ratio

(B) Decrease Current ratio

(C) have no effect on Current ratio

(D) decrease gross profit ratio

Answer

Answer: B

31. Assuming that the current ratio is 2 : 1, Cash paid against Bills Payable would:

(A) increase current ratio

(B) Decrease Current ratio

(C) have no effect on Current ratio

(D) decrease gross profit ratio

Answer

Answer: A

32. Assuming liquid ratio of 1.2 : 1, cash collected from debtors would :

(A) increase liquid ratio

(B) decrease liquid ratio

(C) have no effect on liquid ratio

(D) increase gross profit ratio

Answer

Answer: C

33. Liquid Assets :

(A) Current Assets – Prepaid Lxp.

(B) Current Assets – Inventory + Prepaid Exp.

(C) Current Assets – Inventory – Prepaid Exp.

(D) Current Assets + Inventory – Prepaid Exp.

Answer

Answer: C

34. Current Assets ₹85,000; Inventory ₹22,000; Prepaid Expenses ₹3,000. Then liquid assets will be :

(A) ₹63,000

(B) ₹60,000

(C) ₹82,000

(D) ₹1,10,000

Answer

Answer: B

35. A Company’s Quick Ratio is 1.5 : 1; Current Liabilities are ₹2,00,000 and Inventory is ₹1,80,000. Current Ratio will be :

(A) 0.9 : 1

(B) 1.9 : 1

(C) 1.4 : 1

(D) 2.4 : 1

Answer

Answer: D

36. A Company’s Quick Ratio is 1.8 : 1; Liquid Assets are ₹5,40,000 and Inventory is ₹1,50,000. Its Current Ratio will be :

(A) 2 : 1

(B) 2.3 : 1

(C) 1.8 : 1

(D) 1.3 : 1

Answer

Answer: B

37. A Company’s Current Ratio is 2.8 : 1; Current Liabilities are ₹2,00,000; Inventory is ₹1,50,000 and Prepaid Expenses are ₹10,000. Its Liquid Ratio will be :

(A) 3.6 : 1

(B) 2.1 : 1

(C) 2 : 1

(D) 2.05 : 1

Answer

Answer: C

38. A Company’s Current Ratio is 3 : 1; Current Liabilities are ₹2,50,000; Inventory is ₹60,000 and Prepaid Expenses are ₹5,000. Its Liquid Assets will be :

(A) ₹6,90,000

(B) ₹6,95,000

(C) ₹6,85,000

(D) ₹8,15,000

Answer

Answer: C

39. On the basis of following data, the liquid ratio of a company will be : Current Ratio 5 : 3; Current Liabilities ₹75,000 and Inventory ₹25,000

(A) 1 : 1

(B) 2:1.8

(C) 3 : 2

(D) 4 : 3

Answer

Answer: D

40. Current ratio of a firm is 9 : 4. Its current liabilities are ₹1,20,000. Inventory is ₹30,000. Its liquid ratio will be :

(A) 1 : 1

(B) 1.5 : 1

(C) 2 : 1

(D) 1.6 : 1

Answer

Answer: C

41. A firm’s current ratio is 3.5 : 2. Its current liabilities are ?80,000. Its working capital will be :

(A) ₹1,20,000

(B) ₹1,60,000

(C) ₹60,000

(D) ₹2,80,000

Answer

Answer: C

42. A Company’s Current Ratio is 3 : 1 and Liquid Ratio is 1.2 : 1. If its Current Liabilities are ₹2,00,000, what will be the value of Inventory?

(A) ₹2,40,000

(B) ₹3,60,000

(C) ₹4,00,000

(D) ₹40,000

Answer

Answer: B

43. A Company ’ s Current Ratio is 2.5 : 1 and Liquid Ratio is 1.6 : 1. If its Current Assets are ₹7,50,000, what will be the value of Inventory?

(A) ₹4,50,000

(B) ₹4,80,000

(C) ₹2,70,000

(D) ₹1,80,000

Answer

Answer: C

44. Current Ratio of a Company is 2.5 : 1. If its working capital is ₹60,000, its current liabilities will be :

(A) ₹40,000

(B) ₹60,000

(C) ₹1,00,000

(D) ₹24,000

Answer

Answer: A

45. A Company’s Current Assets are ₹6,00,000 and working capital is ₹2,00,000. Its Current Ratio will be :

(A) 3 : 1

(B) 1.5 : 1

(C) 2 : 1

(D) 4 : 1

Answer

Answer: B

46. A Company’s Current Ratio is 2.4 : 1 and Working Capital is ₹5,60,000. If its Liquid Ratio is 1.5, what will be the value of Inventory?

(A) ₹6,00,000

(B) ₹2,00,000

(C) ₹3,60,000

(D) ₹6,40,000

Answer

Answer: C

47. A Company’s Current Ratio is 2.5 : 1 and its Working Capital is ₹60,000. If its Inventory is ₹52,000, what will be the liquid Ratio?

(A) 2.3 : 1

(B) 2.8 : 1

(C) 1.3 : 1

(D) 1.2 : 1

Answer

Answer: D

48. If a Company’s Current Liabilities are ₹80,000; Working Capital is ₹2,40,000 and Inventory is ₹40,000, its quick ratio will be:

(A) 3.5 : 1

(B) 4 : 1

(C) 4.5 : 1

(D) 3 : 1

Answer

Answer: A

49. A Company’s Liquid Assets are ₹2,00,000, Inventory is ₹1,00,000, Prepaid Expenses are ₹20,000 and Working Capital is ₹2,40,000. Its Current Ratio will be:

(A) 1.33 : 1

(B) 4 : 1

(C) 2.5 : 1

(D) 3 : 1

Answer

Answer: B

(B) Solvency Ratios

50. Long term solvency is indicated by :

(A) Current Ratio

(B) Quick Ratio

(C) Net Profit Ratio

(D) Debt/Equity Ratio

Answer

Answer: D

51. Debt Equity Ratio is :

(A) Liquidity Ratio

(B) Solvency Ratios

(C) Activity Ratio

(D) Operating Ratio

Answer

Answer: B

52. Debt Equity Ratio is :

(A) Long Term Debts/Shareholder’s Funds

(B) Short Term Debts/Equity Capital

(C) Total Assets/Long term Debts

(D) Shareholder’s Funds/Total Assets

Answer

Answer: A

53. Proprietary Ratio is :

(A) Long term Debts/Shareholder’s Funds

(B) Total Assets/Shareholder’s Funds

(C) Shareholder’s Funds/Total Assets

(D) Shareholder’s Funds/Fixed Assets

Answer

Answer: C

54. Fixed Assets ₹5,00,000; Current Assets ₹3,00,000; Equity Share Capital ₹4,00,000; Reserve ₹2,00,000; Long-term Debts ₹40,000. Proprietary Ratio will be :

(A) 75%

(B) 80%

(C) 125%

(D) 133%

Answer

Answer: A

55. The ………….. ratios provide the information critical to the long run operation of the firm.

(A) Liquidity

(B) Activity

(C) Solvency

(D) Profitability

Answer

Answer: C

56. If Debt equity ratio exceeds , it indicates risky financial position.

(A) 1 : 1

(B) 2 : 1

(C) 1 : 2

(D) 3 : 1

Answer

Answer: B

57. In debt equity ratio, debt refers to :

(A) Short Term Debts

(B) Long Term Debts

(C) Total Debts

(D) Debentures and Current Liabilities

Answer

Answer: B

58. Proprietary Ratio indicates the relationship between Proprietor’s Funds and

(A) Long-Term Debts

(B) Short Term & Long Term Debts

(C) Total Assets

(D) Debentures

Answer

Answer: C

59. The formula for calculating the Debt Equity Ratio is :

Answer

Answer: D

60. Equity Share Capital ₹20,00,000; Reserve 5,00,000; Debentures ₹10,00,000; Current Liabilities ₹8,00,000. Debt-equity ratio will be :

(A) .4 ; 1

(B) .32 : 1

(C) .72 : 1

(D) .5 : 1

Answer

Answer: A

61. Debt equity ratio of a company is 1 : 2. Which of the following transactions will increase it:

(A) Issue of new shares for cash

(B) Redemption of Debentures

(C) Issue of Debentures for cash

(D) Goods purchased on credit

Answer

Answer: C

62. Satisfactory ratio between Long-term Debts and Shareholder’s Funds is :

(A) 1 : 1

(B) 3 : 1

(C) 1 : 2

(D) 2 : 1

Answer

Answer: D

63. On the basis of following data, the Debt-Equity Ratio of a Company will be:

Equity Share Capital ₹5,00,000; General Reserve ₹3,20,000; Preliminary Expenses ₹20,000; Debentures ₹3,20,000; Current Liabilities ₹80,000.

(A) 1 : 2

(B) 52 : 1

(C) 4 : 1

(D) 37 : 1

Answer

Answer: C

64. On the basis of following information received from a firm, its Debt-Equity Ratio will be :

Equity Share Capital ₹5,80,000; Reserve Fund ₹4,30,000; Preliminary Expenses ₹40,000; Long term Debts ₹1,28,900; Debentures ₹2,30,000.

(A) 42 : 1

(B) 53 : 1

(C) 63 : 1

(D) 37 : 1

Answer

Answer: D

65. On the basis of following data, the proprietary ratio of a Company will be :

Equity Share Capital ₹6,00,000; Debentures ₹2,40,000; Statement of Profit & Loss Debit Balance ₹40,000.

(A) 74%

(B) 65%

(C) 82%

(D) 70%

Answer

Answer: D

66. On the basis of following information received from a firm, its Proprietary Ratio will be :

Fixed Assets ?3,30,000; Current Assets ₹1,90,000; Preliminary Expenses ₹30,000; Equity Share Capital ₹2,44,000; Preference Share Capital ₹1,70,000; Reserve Fund ₹58,000.

(A) 70%

(B) 80%

(C) 85%

(D) 90%

Answer

Answer: C

67. On the basis of following data, a Company’s Total Assets-Debt Ratio will be: Working Capital ₹2,70,000; Current Liabilities ₹30,000; Fixed Assets ₹4,00,000; Debentures ₹2,00,000; Long Term Bank Loan ₹80,000.

(A) 37%

(B) 40%

(C) 45%

(D) 70%

Hint: Working Capital + Current Liabilities = Current Assets

Answer

Answer: B

68. On the basis of following information received from a firm, its Total Assets-Debt Ratio will be :

Working Capital ₹3,20,000; Current Liabilities ₹1,40,000; Fixed Assets ₹2,60,000; Debentures ₹2,10,000; Long Term Bank Debt ₹78,000.

(A) 40%

(B) 60%

(C) 30%

(D) 70%

Answer

Answer: A

(C) Activity Ratios

69. Inventory Turnover Ratio is:

(A) Average Inventory/Revenue from Operations

(B) Average Inventory/Cost of Revenue from Operations

(C) Cost of Revenue from Operations/Average Inventory

(D) G.P./Average Inventory

Answer

Answer: C

70. Opening Inventory ₹1,00,000; Closing Inventory ₹1,50,000; Purchases ₹6,00,000; Carriage ₹25,000; Wages ₹2,00,000. Inventory Turnover Ratio will be :

(A) 6.6 Times

(B) 7.4 Times

(C) 7 Times

(D) 6.2 Times

Answer

Answer: D

71. Revenue from Operations ₹8,00,000; Gross Profit Ratio 25%; Opening Inventory ₹1,00,000; Closing Inventory ₹60,000. Inventory Turnover Ratio will be :

(A) 10 Times

(B) 7.5 Times

(C) 8 Times

(D) 12.5 Times

Answer

Answer: B

72. On the basis of following data, the cost of revenue from operations by a company will be :

Opening Inventory ₹70,000; Closing Inventory ?₹80,000; Inventory Turnover Ratio 6 Times.

(A) ₹1,50,000

(B) ₹90,000

(C) ₹4,50,000

(D) ₹4,80,000

Answer

Answer: C

73. Opening Inventory of a firm is ₹80,000. Cost of revenue from operations is ?6,00,000. Inventory Turnover Ratio is 5 times. Its closing Inventory will be:

(A) ₹1,60,000

(B) ₹1,20,000

(C) ₹80,000

(D) ₹2,00,000

Answer

Answer: A

74. Cost of revenue from operations ₹6,00,000; Inventory Turnover Ratio 5; Find out the value of opening inventory, if opening inventory is ₹8,000 less than ” the closing inventory.

(A) ₹1,12,000

(B) ₹1,16,000

(C) ₹1,28,000

(D) ₹1,24,000

Answer

Answer: B

75. Revenue from Operations ₹2,00,000; Inventory Turnover Ratio 5; Gross Profit 25%. Find out the value of Closing In ventory, if Closing Inventory is ₹8,000 more than the Opening Inventoiy.

(A) ₹38,000

(B) ₹22,000

(C) ₹34,000

(D) ₹26,000

Answer

Answer: C

76. If the inventory turnover ratio is divided into 365, it becomes a measure of

(A) Sales efficiency

(B) Average Age of Inventory

(C) Sales Turnover

(D) Average Collection Period

Answer

Answer: B

77. If average inventory is ₹50,000 and closing inventory is ₹2,000 less than the opening inventory, opening and closing inventory will be :

(A) ₹52,000 and ₹50,000

(B) ₹50,000 and ₹48,000

(C) ₹48,000 and ₹46,000

(D) ₹51,000 and ₹49,000

Answer

Answer: D

78. Opening Inventory ₹50,000; Closing Inventory ₹40,000 and cost of revenue from operations ₹7,20,000. What will be Inventory Turnover Ratio?

(A) 18 Times

(B) 16 Times

(C) 14.4 Times

(D) 8 Times

Answer

Answer: B

79. Average Inventory ₹60,000; Inventory Turnover Ratio 8; Gross Profit 20% on revenue from operations; what will be Gross Profit?

(A) ₹1,20,000

(B) ₹96,000

(C) ₹80,000

(D) ₹15,000

Answer

Answer: A

80. Opening Inventory ₹75,000; Closing Inventory ₹1,05,000; Inventory Turnover Ratio 6; Gross Profit 20% on cost; what will be Gross Profit?

(A) ₹1,35,000

(B) ₹1,08,000

(C) ₹90,000

(D) ₹18,000

Answer

Answer: B

81. Opening Inventory ₹40,000; Purchase ₹4,00,000; Purchase Return ₹12,000, what will be Inventory turnover ratio if Closing Inventory is less than Opening Inventory by ₹8,000?

(A) 9 Times

(B) 10.78 Times

(C) 11 Times

(D) 8.82 Times

Answer

Answer: C

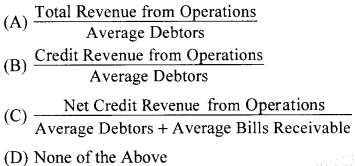

82. The formula for calculating the Trade Receivables Turnover Ratio is :

Answer

Answer: C

83. Total revenue from operations ₹9,00,000; Cash revenue from operations ₹3,00,000; Debtors ₹1,00,000; B/R ₹20,000. T rade Receivables Turnover Ratio will be :

(A) 5 Times

(B) 6 Times

(C) 7.5 Times

(D) 9 Times

Answer

Answer: A

84. Total revenue from operations ₹27,00,000; Credit revenue from operations ₹18,00,000; Opening Debtors ₹3,20,000; Closing Debtors ₹4,00,000; Provision for Doubtful Debts ₹60,000. Trade Receivables Turnover Ratio will be :

(A) 7.5 times

(B) 9 times

(C) 6 times

(D) 5 times

Answer

Answer: D

85. Credit revenue from operations ₹24,00,000; Trade Receivables Turnover Ratio 6 times; Opening Debtors ₹3,20,000. Closing Debtors will be :

(A) ₹4,00,000

(B) ₹4,80,000

(C) ₹80,000

(D) ₹7,20,000

Answer

Answer: B

86. A firm makes credit revenue from operations of ₹2,40,000 during the year. If the trade receivables turnover ratio is 8 times, calculate closing debtors, if the closing debtors are more by ₹6,000 than the opening debtors :

(A) ₹33,000

(B) ₹36,000

(C) ₹24,000

(D) ₹27,000

Answer

Answer: A

87. Credit revenue from operations ₹3,00,000. Trade Receivables Turnover Ratio 5; Calculate Closing Debtors, if closing debtors are two times in comparison to Opening Debtors.

(A) ₹40,000

(B) ₹60,000

(C) ₹ 80,000

(D) ₹1,20,000

Answer

Answer: C

88. Credit revenue from operations ₹5,60,000; Debtors ₹70,000; B/R ₹10,000. Average Collection Period will be :

(A) 52 Days

(B) 53 Days

(C) 45 Days

(D) 46 Days

Answer

Answer: B

89. Credit revenue from operations ₹6,00,000; Cash revenue from operations ? 1,50,000; Debtors ₹1,00,000; B/R ₹50,000. Average Collection Period will be :

(A) 2 Months

(B) 2.4 Months

(C) 3 Months

(D) 1.6 Months

Answer

Answer: C

90. On the basis of following data, a Company’s closing debtors will be:

Credit revenue from operations ₹9,00,000; Average Collection period 2 months; Opening debtors are ₹15,000 less as compared to closing debtors.

(A) ₹1,42,500

(B) ₹1,57,500

(C) ₹1,80,000

(D) ₹75,000

Answer

Answer: B

91. Total credit revenue from operations of a firm is ₹5,40,000. Average collection period is 3 months. Opening debtors are ₹1,10,000. Its closing debtors will be :

(A) ₹1,35,000

(B) ₹1,60,000

(C) ₹2,20,000

(D) ₹1,80,000

Answer

Answer: B

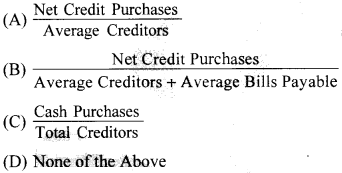

92. The formula for calculating Trade Payables Turnover Ratio is :

Answer

Answer: B

93. Credit Purchases ₹12,00,000; Opening Creditors ₹2,00,000; Closing Creditors ₹1,00,000. Trade Payables Turnover Ratio will be :

(A) 6 times

(B) 4 times

(C) 8 times

(D) 12 times

Answer

Answer: C

94. Total Purchases ₹4,50,000; Cash Purchases ₹1,50,000; Creditors ₹50,000; Bills Payable ₹10,000. Trade Payables Turnover Ratio will be :

(A) 7.5 times

(B) 6 times

(C) 9 times

(D) 5 times

Answer

Answer: D

95. Credit Purchases ₹6,00,000; Trade Payables Turnover Ratio 5; Calculate closing creditors, if closing creditors are ? 10,000 less than opening creditors.

(A) ₹1,15,000

(B) ₹1,25,000

(C) ₹1,30,000

(D) ₹1,10,000

Answer

Answer: A

96. Credit Purchases ₹9,60,000; Cash Purchases ₹6,40,000; Creditors ₹2,40,000; Bills Payable ₹80,000. Average Payment Period will be :

(A) 3 months

(B) 4 months

(C) 2.4 months

(D) 6 months

Answer

Answer: B

97. Current Assets ₹5,00,000; Current Liabilities ₹1,00,000; Revenue from Operations ₹28,00,000. Working Capital turnover Ratio will be:

(A) 7 times

(B) 5.6 times

(C) 8 times

(D) 10 times

Answer

Answer: A

98. On the basis of following data, the Waiting Capital Turnover Ratio of a company will be :

Liquid Assets ₹3,70,000; Inventory ₹80,000; Current Liabilities ₹1,50,000; Cost of levcnue from operations ₹7,50,000.

(A) 2.5 Times

(B) 3 Trimes

(C) 5 Times

(D) 3.8 Times

Answer

Answer: A

99. A firm’s cwTent assets are ₹3,60,000; Cur from operations is ₹12,00,000. Its worki

(A) 3 Times

(B) 5 Trimes

(C) 8 Times

(D) 4 Times

Answer

Answer: B

(D) Profitability Ratios

100. Opening Inventory ₹1,00,000; Closing Inventory ₹1,20,000; Purchases ₹20,00,000; Wages ₹2,40,000; Carriage Inwards ₹1,50,000; Selling Exp. ₹60,000; Revenue from Operations ₹30,00,000. Gross Profit ratio will be :

(A) 29%

(B) 26%

(C) 19%

(D) 21%

Answer

Answer: D

101. Cash Revenue from Operations ₹4,00,000 Credit Revenue, from Operations ₹21,00,000; Revenue from Operations Return ₹1,00,000; Cost of revenue from operations ₹19,20,000. G.P. ratio will be

(A) 4%

(B) 23.2%

(C) 80%

(D) 20%

Answer

Answer: D

102. A film’s credit revenue from operations is ₹3,60,000, cash revenue from operations is ₹70,000, Cost of reverse from operations is ₹3,61,200, Its gross profit ratio will be :

(A) 11%.

(B) 23.2%

(C) 18%

(D) 20%

Answer

Answer: D

103. On the basis of following data, a Company’s Gross Profit Ratio will be :

Net Profit ₹40,000; Office Expenses ₹20,000; Selling Expenses ₹36,000; Total revenue from operations ₹6,00,000.

(A) 16%

(B) 20%

(C) 6.67%

(D) 12.5%

Answer

Answer: A

104. What will be the amount of Gross Profit. if revenue from operations are ₹6,00,000 and Gross . Profit Ratio is 20% of cost?

(A) ₹1,50,000

(B) ₹1,00,000

(C) ₹1,20,000

(D) ₹5,00,000

Answer

Answer: B

105. What will be the amount of Gross Profit, if revenue from operations are ₹6,00,000 and Gross Profit Ratio 20% of revenue from operations?

(A) ₹1,50,000

(B) ₹1,00,000

(C) ₹1,20,000

(D) ₹5,00,000

Answer

Answer: C

106. Revenue from operations is ₹1,80,000; Rate of Gross Profit is 25% on cost. What will be the Gross Profit?

(A) ₹45,000

(B) ₹36,000

(C) ₹40,000

(D) ₹60,000

Answer

Answer: B

107. Operating ratio is :

(A) Cost of revenue from operations + Selling Expenses/Net revenue from operations

(B) Cost of production + Operating Expenses/Net revenue from operations

(C) Cost of revenue from operations + Operating Expenses/Net Revenue from Operations

(D) Cost of Production/Net revenue from operations.

Answer

Answer: C

108. Cost of Revenue from Operations =

(A) Revenue from Operations – Net Profit

(B) Revenue from Operations – Gross Profit

(C) Revenue from Operations – Closing Inventory

(D) Purchases – Closing Inventory

Answer

Answer: B

109. Total Revenue from Operations ₹15,00,000; Cost of Revenue from Operations ₹9,00,000 and Operating Expenses ₹2,25,000. Calculate operating ratio :

(A) 75%

(B) 25%

(C) 60%

(D) 15%

Answer

Answer: A

110. Purchases ₹7,20,000; Office Expenses ₹30,000; Selling Expenses ₹90,000; Opening Inventory ₹1,40,000; Closing Inventory ₹80,000; Revenue from Operations ₹12,00,000. Calculate operating ratio

(A) 60%

(B) 75%

(C) 70%

(D) 65%

Answer

Answer: B

111. Revenue from Operations ₹6,00,000; Gross Profit 20%; Office Expenses ₹30,000; Selling Expenses ?₹48,000. Calculate operating ratio (A) 80%

(B) 85%

(C) 96.33%

(D) 93%

Answer

Answer: D

112. Which of the following is not operating expenses?

(A) Office Expenses

(B) Selling Expenses

(C) Bad Debts

(D) Loss by Fire

Answer

Answer: D

We hope the given Accountancy MCQs for Class 12 with Answers Chapter 14 Accounting Ratios will help you. If you have any query regarding CBSE Class 12 Accountancy Accounting Ratios MCQs Pdf, drop a comment below and we will get back to you at the earliest.