In this page, you can find CBSE Class 10 Economics Chapter 3 Extra Questions and Answers Money and Credit Pdf free download, NCERT Extra Questions for Class 10 Social Science will make your practice complete.

Class 10 Economics Chapter 3 Extra Questions and Answers Money and Credit

Money and Credit Class 10 Extra Questions and Answer Economics Chapter 3 Very Short Answers Type

Question 1.

Recognise the situation when both the parties in a barter economy have to agree to sell and I buy each other’s commodities. What is it called?

Answer:

It is called double coincidence of wants.

Question 2.

Amit is using his money to buy assets like house, commercial land and machines. Write what is he actually doing?

Answer:

He is investing his money with a hope of earning profits from these assets.

Question 3.

Why do banks ask for collateral while giving credit to the borrower?

Answer:

If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

Question 4.

What is the meaning of ‘barter system’?

Answer:

To exchange goods, services, property, etc. for other goods, etc. without using money.

Question 5.

What is meant by double coincidence of wants?

Answer:

When both the parties in a barter system have to agree to sell and buy each other’s commodities, it is called double coincidence of wants.

Question 6.

How does money act as a medium of exchange?

OR

How does the use of money make it easier to exchange things?

Answer:

A person holding money can easily exchange it for any commodity or service that he/she wants.

Question 7.

What is a cheque?

Answer:

A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

Question 8.

What is the source of income for the banks?

Answer:

Banks charge a higher interest rate on loans than what they offer on deposits. The difference between what is charged from borrowers and what is paid to depositors is the main source of income for the banks.

Question 9.

What did Indians use as money in the early ages?

Answer:

In the early ages, they used grains and cattle as money.

Question 10.

What do modern forms of money include?

Answer:

Modern forms of money include currency i.e. paper notes and coins.

Question 11.

The modern currency is without any use of its own. Then, why is it accepted as a medium of exchange?

Answer:

It is accepted as a medium of exchange because the currency is authorised by the government of the country.

Question 12.

What are called demand deposits?

Answer:

The deposits in the bank accounts can be withdrawn on demand. Hence, these deposits are called demand deposits.

Question 13.

What is an essential characteristic of money?

Answer:

Money is a medium of exchange.

Question 14.

What do people do with surplus money?

Answer:

They deposit it with the banks by opening a bank account in their name.

Question 15.

What do banks do with the money we deposit there?

Answer:

Banks keep a small proportion of their deposits as cash with themselves and use the major portion to extend loans.

Question 16.

Why do people in rural areas demand for credit? Give one reason.

Answer:

People in rural areas demand for credit for the purpose of crop production.

Question 17.

What is called debt trap?

Answer:

When credit pushes the borrower into a situation from which recovery is very painful, it is called debt trap.

Question 18.

What are the terms of credit?

Answer:

Interest rate, collateral and documentation requirement, and the mode of repayment together are called the terms of credit.

Question 19.

What prevents the poor from getting bank loans?

Answer:

Absence of collateral is one of the main reasons which prevents the poor from getting bank loans.

Question 20.

What are the two benefits of deposits with the banks?

Answer:

- People’s money is safe with the banks and it earns an amount as interest.

- People also have the provision to withdraw the money as and when they require.

Question 21.

How does the facility of cheques against demand deposits help one?

Answer:

The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash.

Question 22.

What do you mean by ‘easy terms of credit’?

Answer:

Easy terms of credit include low interest rate, easy conditions for repayment and less collateral and documentation requirements.

Money and Credit Class 10 Extra Questions and Answer Economics Chapter 3 Short Answers Type

Question 1.

Dhananjay is a government employee and belongs to a rich household whereas Raju is a construction worker and comes from a poor rural household. Both are in need and wish to take loan. Create a list of arguments explaining who between the two would successfully be able to arrange money from a formal source. Why?

Answer:

Dhananjay will be able to get loan from a formal source.

Arguments

- Dhananjay is a government employee and belongs to a rich household.

- He has capacity to repay the loan within given frame of time.

- Since he is well-off, he has enough collateral which he can use as a guarantee to the bank until the loan is repaid.

Question 2.

Why is it necessary for the banks and cooperative societies to increase their lending facilities in rural areas? Explain.

Answer:

(i) Banks and cooperative societies can help people in obtaining cheap and affordable loans.

(ii) This will empower people in a variety of ways. They could grow corps, do business, set up small- scale industries etc. They could set up new industries or trade in goods.

(iii) Loans from informal lenders carry a very high interest rate and do little to increase the income of the borrowers. Thus, it is necessary that banks and cooperatives increase their lending particularly in the rural areas, so that the dependence on informal sources of credit reduces. Cheap and affordable credit is also important for the country’s development.

Question 3.

Why is modern currency accepted as a medium of exchange without any use of its own? Find out the reasons.

Answer:

(i) Modern forms of money include currency-paper notes and coins. Unlike the things that were used as money earlier, the modern currency is without any use of its own. But it is accepted as a medium of exchange because the currency is authorised by the government of the country.

(ii) In India, the Reserve Bank of India issues currency notes on behalf of the Central Government. As per Indian law, no other individual or organisation is allowed to issue currency.

(iii) Moreover, the law legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India. No individual in India can legally refuse a payment made in rupees.

Question 4.

Mention some of the uses of money.

Answer:

(i) The use of money spans a very large part of our daily life. We make several transactions involving money every day. In many of these transactions, goods are being bought and sold with the use of money. In some of these transactions, services are being exchanged with money.

(ii) A person holding money can easily exchange it for any commodity or service that he/she might want. Thus everyone prefers to receive payments in money and then exchange the money for things that they want.

(iii) In an economy where money is in use, money by providing the crucial intermediate step eliminates the need for double coincidence of wants. It is no longer necessary for both parties to agree to sell and buy each other’s commodities.

Question 5.

“Money has made transactions easy.” Justify.

Answer:

(i) Money is something that can act as a medium of exchange in transactions. It serves as a unit of value. A person holding money can easily exchange it for any commodity or service that he/she might want.

(ii) People can deposit extra money with banks. They deposit it with the banks by opening a bank account in their name. They also have the provision to withdraw the money as and when they require.

(iii) We can make payments through cheques instead of cash. For payment through cheques, the payer who has an account with the bank, makes out a cheque for specific amount.

Question 6.

How does money solve the problem of double coincidence of wants? Explain with an example.

Answer:

In the barter system, commodities are exchanged with commodities without the use of money. In this type of exchange, both parties have to agree to sell and buy each other’s commodities. This is known as double coincidence of wants. What a person desires to sell is exactly what the other wishes to buy. Money solves the problem of double coincidence of wants by acting as a medium of exchange.

A person holding money in hand can easily exchange it for any commodity or service that he/she wants. We can better understand it with an example. Suppose a green grocer wants a mobile phone but the owner of the mobile phone wants a wrist watch. In such a situation, the green grocer can use money to get the mobile phone. In the same way, the mobile phone owner too will use money to get the wrist watch.

Both parties are independent to buy the things of their need because both have money. In this way, money solves the problem of double coincidence of wants.

Question 7.

Why do lenders ask for collateral while lending? Give any three reasons.

Answer:

If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment. It is, therefore, lenders ask for collateral while lending.

Question 8.

Explain with an example how credit plays a vital and positive role for development.

Answer:

(i) A large number of transactions in our day-to-day activities involve credit in some form or the other. Credit means loan which the borrower gets from the lender in the form of money, goods or services in return for the promise of future payment.

(ii) Credit can play a vital and positive role in a certain situation. Suppose a small businessman obtains credit to expand his business. If he gets success in his goal and makes a good profit, he will repay the money in time that he had borrowed.

(iii) He will then spend the surplus money in expanding his business. If this continues for a few years, he will become an established businessman. Here, credit helps to increase earnings and therefore the person is better off than before.

Question 9.

How is money used as a medium of exchange? Explain with examples.

Answer:

(i) Modern forms of money include currency-paper notes and coins. Unlike the things that were used as money earlier, the modern currency is without any use of its own. But it is accepted as a medium of exchange because the currency is authorised by the government of the country.

(ii) In India, the Reserve Bank of India issues currency notes on behalf of the Central Government. As per Indian law, no other individual or organisation is allowed to issue currency.

(iii) Moreover, the law legalises the use of rupee as a medium of payment that cannot be refused in settling transactions in India. No individual in India can legally refuse a payment made in rupees.

Question 10.

What is money? Why is modern currency accepted as a medium of exchange?

Answer:

Money is a medium of exchange in transactions. A person holding money can easily exchange it for any commodity or service that he/she might want.

In India, the Reserve Bank of India issues currency notes on behalf of the Central Government. As per Indian law, no other individual or organisation is allowed to issue currency.

Question 11.

How do demand deposits facilitate transactions?

Answer:

Demand deposits share the essential features of money. The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash. Since demand deposits are accepted widely as a medium of payment, along with currency, they constitute money in the modern economy.

Question 12.

How can money easily exchange it for goods or services? Give example to explain.

Answer:

(i) The use of money spans a very large part of our daily life. We make several transactions involving money every day. In many of these transactions, goods are being bought and sold with the use of money. In some of these transactions, services are being exchanged with money.

(ii) A person holding money can easily exchange it for any commodity or service that he/she might want. Thus everyone prefers to receive payments in money and then exchange the money for things that they want.

(iii) In an economy where money is in use, money by providing the crucial intermediate step eliminates the need for double coincidence of wants. It is no longer necessary for both parties to agree to sell and buy each other’s commodities.

Money and Credit Class 10 Extra Questions and Answer Economics Chapter 3 Long Answers Type

Question 1.

Compare and contrast the conditions for taking loan from formal and informal sources. Suggest an alternative source that you think is best for the rural poor.

Answer:

Formal

- Banks, Co-operatives

- Low rate of interest

- No unfair means adopted to take back the money if no re-payment is done.

- Supervised by RBI

- Have to adhere to terms of credit as collateral rate of interest. Mode of payment and documents.

Informal

- Moneylender, relatives, landlords

- High rate of interest

- Other conditions like cultivate land during harvest time etc.

- Unfair measures

- Not supervised

Self Help Groups is an alternative source. They help borrowers overcome the problem of lack of collateral. The borrowers can get timely loans for a variety of purposes and at a reasonable interest rate. Moreover, SHGs are the building blocks of organisation of the rural poor. Not only does it help women to become financially self-reliant, the regular meetings of the group provide a platform to discuss and act on social issues like health, nutrition, etc.

Question 2.

How do banks play an important role in the economy of India? Explain.

OR

How are deposits with the banks beneficial for an individual as well as for the nation? Explain with examples.

Answer:

(i) Banks provide people the facility to deposit their surplus money by opening a bank account in their name. Banks also pay an amount as interest on the deposits. In this way, people’s money is safe with the banks and it earns an amount as interest. Thus, banks add to the income of the family.

(ii) Banks use the major portion of the deposits to extend loans to the needy. There is a huge demand for loans for various economic activities. Banks, thus, mediate between those who have surplus money and those who are in need of this money.

(iii) Banks give loans not just to profit-making businesses and traders but also to small cultivators, small-scale industries, to small borrowers, etc. Thus, they empower these people and help indirectly in the country’s development.

(iv) The rate of interest that banks demand from the borrowers is always cheap and affordable. This helps people to improve their condition. Banks also give loans to industrialists. These industrialists use these loans to expand their industries. In this way, they contribute in country’s development.

(v) By employing a large number of people banks solve the problem of unemployment to a great extent.

Question 3.

What is credit? How does credit play a vital and positive role? Explain with an example.

Answer:

Credit means loan. It refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

(i) A large number of transactions in our day-to-day activities involve credit in some form or the other. Credit means loan which the borrower gets from the lender in the form of money, goods or services in return for the promise of future payment.

(ii) Credit can play a vital and positive role in a certain situation. Suppose a small businessman obtains credit to expand his business. If he gets success in his goal and makes a good profit, he will repay the money in time that he had borrowed.

(iii) He will then spend the surplus money in expanding his business. If this continues for a few years, he will become an established businessman. Here, credit helps to increase earnings and therefore the person is better off than before.

Question 4.

What are the various sources of credit in rural areas? Which one of them is the most dominant source of credit and why?

Answer:

The various sources of credit in rural areas are-moneylenders, cooperative societies/banks, commercial banks, relatives and friends, institutional and non-institutional agencies and landlords, etc. Moneylenders constitute an informal source of credit. They are the most dominant source of credit in rural areas.

There are various reasons behind it-

- They know the borrowers personally and hence, are often willing to give a loan without collateral.

- The borrowers can, if necessary, approach the moneylenders even without repaying their earlier loans.

- Although these moneylenders charge very high rate of interest and keep no records of the transactions, they are easily accessible.

Question 5.

What are the two categories of sources of credit? Mention four features of each.

Answer:

| Formal | Informal |

| (i) Among the formal sector people can take loans from banks and cooperatives. | (i) The informal lenders include moneylenders, traders, employers, relatives and friends, etc. |

| (ii) The Reserve Bank of India supervises the functioning of formal sources of loans. | (ii) There is no organisation which supervises the credit activities of lenders in the informal sector. |

| (iii) Formal sector loans are given at a low rate of interest. | (iii) Informal sector loans are given at a high rate of interest. |

| (iv) It is the richer households who receive credit from formal sources. | (iv) The poor have to depend on the informal sources. |

| (v) Formal sector loans require documentation and collateral. This is used as a guarantee to the lender until the loan is paid back. | (v) Informal sector loans do not require collateral. |

Money and Credit Class 10 Extra Questions and Answer Economics Chapter 3 Higher Order Thinking Skills (HOTS) Questions

Question 1.

Why is cheap and affordable credit important for the country’s development?

Answer:

People need credit (loan) to carry out various economic activities. Some want to do business, some want to buy new houses, some want to set up new industries or trade in goods, and so on. Cheap and affordable credit will help these people to grow in their fields which will ultimately contribute in the county’s development.

In rural India, cheap and affordable credit helps in the development of agriculture and other related activities. We know that a bulk of farmers are poor. They do not have money to buy seeds, fertilisers, and expensive pesticides. Credit enables them to carry out these activities.

Question 2.

What are modern forms of money? Why is the ‘rupee’ widely accepted as a medium of exchange? Give two reasons.

Answer:

Modern forms of money include currency-paper notes and coins. The rupee is widely accepted as a medium of exchange because-

- The law legalises the use of rupee as a medium of payment that cannot be refused in setting

transactions in India. - No individual in India can legally refuse a payment made in rupees.

Question 3.

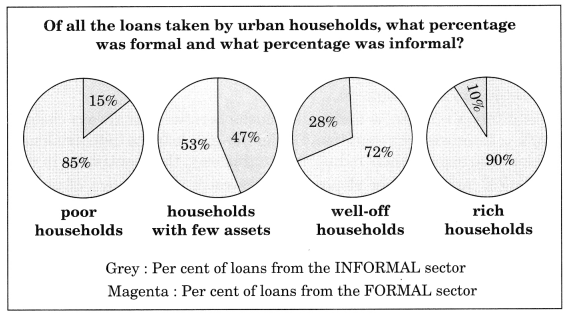

Study the graph given below:

Answer:

The above graph shows the importance of formal and informal sources of credit for people in urban areas. The people are divided into four groups poor households, households with few assets, well-off households and rich households.

We can see that 85 percent of the loans taken by poor households in the urban areas are from informal sources. When we compare this with the rich urban households, we find that only 10 percent of their loans are from informal sources, while 90 percent are from formal sources.

Money and Credit Class 10 Extra Questions and Answer Economics Chapter 3 Value-based Questions (VBQs)

Question 1.

What are Self-Help Groups? How do they work? Do you think that SHGs fulfil the expectations of the poor people?

Answer:

Self-Help Groups (SHGs) is a small voluntary association of poor people, preferably from the same socio-economic background. They come together for the purpose of solving their common problems through self-help and mutual help. The SHG promotes small savings among its members. A typical SHG has 15-20 members, usually belonging to one neighbourhood, who meet and save regularly.

Saving per member varies from Rs 25 to Rs 100 or more, depending on the ability of the people to save. Members can take small loans from the group itself to meet their needs. The group charges a little interest. After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

Loan is sanctioned in the name of the group and is meant to create self¬employment opportunities for the members. Most of the important decisions regarding the savings and loan activities are taken by the group members. It is also the group which is responsible for the repayment of the loan.

Any case of non-repayment of loan by any one member is followed up seriously by other members. It is this feature of SHG that banks are ready to lend to the poor, even though they have lack of collateral or any other asset. SHGs certainly fulfil the expectations of the poor people. Because the groups solves the economic problem of the poor to some extent the poor people can take loan at less interest rate and do their work according.

Question 2.

‘Cheap and affordable credit is essential for poor households both in rural and urban areas’. In the light of the above statement explain the social and economic values attached to it.

Answer:

Social values attached to credit:

(i) Cheap and affordable credit plays an important role in eradicating poverty and empowering people in different ways.

(ii) Ignorant people are saved from the corrupt moneylenders. This develops self-reliance and financial security among them. They enjoy a certain amount of freedom which was otherwise impossible.

Economic values attached to credit:

(i) Cheap and affordable credit helps people in carrying out their various economic activities. They could grow crops, do business, set up small-scale industries, etc. They could set up new industries or trade in goods.

(ii) Cheap and affordable credit also helps in transforming human beings into valuable resources. Empowered people can contribute fully in the development of the country.

Question 3.

Describe any four advantages of Self-Help Groups for the poor.

Answer:

Self-Help Groups (SHGs) is a small voluntary association of poor people, preferably from the same socio-economic background. They come together for the purpose of solving their common problems through self-help and mutual help. The SHG promotes small savings among its members. A typical SHG has 15-20 members, usually belonging to one neighbourhood, who meet and save regularly.

Saving per member varies from Rs 25 to Rs 100 or more, depending on the ability of the people to save. Members can take small loans from the group itself to meet their needs. The group charges a little interest. After a year or two, if the group is regular in savings, it becomes eligible for availing loan from the bank.

Loan is sanctioned in the name of the group and is meant to create self¬employment opportunities for the members. Most of the important decisions regarding the savings and loan activities are taken by the group members. It is also the group which is responsible for the repayment of the loan.

Any case of non-repayment of loan by any one member is followed up seriously by other members. It is this feature of SHG that banks are ready to lend to the poor, even though they have lack of collateral or any other asset. SHGs certainly fulfil the expectations of the poor people. Because the groups solves the economic problem of the poor to some extent the poor people can take loan at less interest rate and do their work according.