The compilation of these Issue and Redemption of Debentures Notes makes students exam preparation simpler and organised.

Terms of Issue, Interest on Debentures

As we have learned that debentures are an important tool for a company to raise finances and capital without giving away too much equity. Debentures are the primary instrument of debt used by companies around the world. Here we will be learning two more aspects of the accounting of debentures – terms of issue and interest on debentures. Let’s get started.

Terms of Issue

As we know, debentures are an instrument of debt. So when their term expires they have to be redeemed (paid back). So the terms of such redemption are generally mentioned when issuing the debentures. The terms on which the money will be repaid to debenture holders are the terms of the issue of debentures.

Depending on the terms of the issue, debentures can either be redeemed at par or at a premium. Let us take a look.

At Par: This is when debentures will be redeemed at their face value/nominal value. So a debenture issued for face value 100/- will be redeemed also at 100/-.

At Premium: This is when the redemption is at a higher value than the face value of the debenture. Such a premium to be paid will be treated as a capital loss. And while the premium amount is only paid at redemption, it will be shown as a liability since the issue of the debentures.

At Discount: This is when the debentures are redeemed at a price lower than face value. However, this is now only a theoretical concept. Such debentures now cannot be issued.

Accounting Treatment for Terms of Issue

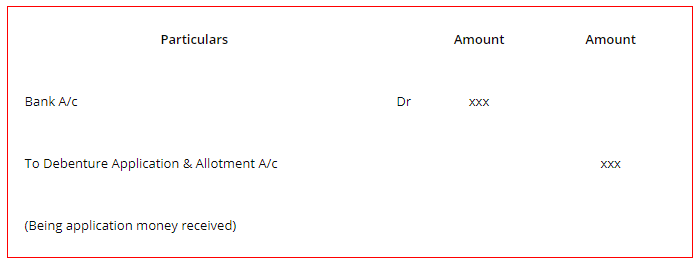

Let us now see the journal entries for the six different scenarios of the terms of the issue. These are the entries passed for the issue of the shares in these different cases.

1. Issued at Par & Redeemable at Par

2. Issued at Discount & Redeemable at Par

3. Issued at Premium & Redeemable at Par

4. Issue at Par & Redeemable at Premium

5. Issued at Discount & Redeemable at Premium

6. Issued at Premium & Redeemable at Premium

Interest on Debentures

Debentures are borrowed capital. So when a company issues debentures they have to pay a rate of interest on them. This interest rate is usually mentioned in the name of the debenture itself, for example, “9% Debentures”. The interest is calculated on the face value of the debentures. This interest amount is paid periodically, generally yearly or half-yearly.

The interest is a charge against the profit of the company. This means that it must be paid, even if the company has earned no profit in that year. So it is unlike dividends paid on shares. Let us see the accounting entries for this interest on debentures.

1. Debenture Interest becomes Due

2. Payment of Interest

3. Debenture Interest being transferred to P & L A/c

4. Payment of TDS to the Government

Example:

Question:

Interest on debenture is __________

a. charge against profit

b. appropriation of profit

c. adjustment of profit

d. none of the above

Answer:

The correct option is “a”.

Debentures are financial instruments which carry a certain percentage of interest. So debentures are like other debts. Interest paid on them is charged against the profit and loss account.