The compilation of these Depreciation, Provision and Reserves Notes makes students exam preparation simpler and organised.

Depreciation and Causes of Depreciation

Perhaps one of the most common accounting concepts, Depreciation is a topic that requires in-depth and conceptual study. In order to gain a fundamental understanding of the subject, it is very important to understand the basics of this chapter. Before learning any definitions and formulas in this chapter, one needs to understand the causes of depreciation.

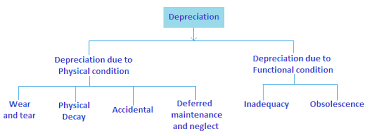

The Causes of Depreciation

Depreciation can be easily defined as a reduction in the carrying amount of a fixed asset. Depreciation is equated with a value of consumption of the asset for a specific period. Over the span of an asset, over which it is considered usable, depreciation brings down the value of the asset to a salvage value.

This salvage value is the sum of money that is expected to accrue to the owner if he makes a sale of the asset. Or it can be said to be the scrap value that he gets on the disposal of the asset. Following are the causes of depreciation:

Wear and Tear of the Asset

Every machinery or tool is bound to undergo wear over a period of time. There will be parts that may need replacing or repairing. Usually, such assets have a fixed span of life, after which, they need to be scrapped. This wear and tear of the asset must be accounted for in financial terms, hence depreciation.

Perishability of Inventory

Items such as raw material and inventory, undergone deterioration over a quick span of time. This is faster in relation to a fixed asset, which normally lasts for a few years at least. This perishability of assets is a point of consideration for depreciation accounting.

Usage Right Expiration

Some assets such as software and licenses have a typical span over which it can be used. As soon as this time span finishes, the owner has to give up using the asset. So the depreciation of this asset must be done over time, it cannot just be written off on the day of expiration.

Obsolescence

Another cause of depreciation is the absolute nature of certain assets. Over a period of time, every asset loses its novel value. A new alternative can always be developed for replacing the asset and its functions.

Need to Comply with Accounting Standards

As per the guidelines set down in the standard of accounting, a firm needs to follow the matching concept. This means that the funds for replacing the asset are set aside at regular intervals. Also, the expense related to each period is charged to that period simultaneously.

It is mandatory to provide depreciation as per Accounting standard 6 and the Companies Act, 2013. Not providing depreciation during a year is also a violation of the accounting standard and the provisions stated therein. Further, providing for depreciation ensures that the accounts of a firm present a true and fair view of the financial status of the firm.

Example:

Question:

X Corporation purchases the special deluxe machine for INR 60,000. It has an estimated salvage value of INR 10,000 and also a useful life of five years. How will X calculate straight-line depreciation for the machine for the year ending?

Answer:

Calculation of Depreciation is done as follows:

Purchase cost of INR – estimated salvage value of INR = Depreciable asset cost of INR

60,000 – 10,000 = 50,000

Depreciation = Depriciable Cost / Useful Life = 50,000/5 years

Depreciation = Rs. 10,000/- per year.